Autonomous Driving: The Bigger Picture

What comes to mind first when you think of autonomous driving? Most likely we would think about self-driving cars with adaptive cruising technology like Tesla Autopilot. Indeed, adaptive cruising supported by sensors and cameras is a core component of autonomous driving. Yet this is only a small part of the bigger picture. In fact, no matter how advanced and sophisticated adaptive cruising technology becomes, there will always be room for error to occur in situations like extreme weather events and unexpected road conditions.

Therefore, the vehicle alone is not sufficient to ensure a perfectly safe and seamless autonomous driving experience. To complete the full picture, cooperative intelligent transport systems (C-ITS) is needed to ensure that every vehicle on the road knows exactly what they need to know at the right time and the right place.

Intelligent Transportation Systems

Before looking at C-ITS, let us first look at what intelligent transport systems (ITS) are. These are the systems that collect and analyze data to improve the driving experience as well as to regulate traffic. Examples of ITS include the modern GPS navigation system which provides drivers with real-time information on traffic levels, estimated travel times, traffic accidents, road constructions, and even locations of traffic enforcement cameras. Another interesting ITS is the left-turn lane sensor, which are sensors embedded on the grounds of the left-turn lane at intersections, so that the left-turn signal would only turn on when needed.

C-ITS are simply more advanced ITS where vehicles and other road entities share their data to “cooperate” with each other on the road. Such cooperation is made possible by V2X (vehicle-to-everything) technology, which allows vehicles to communicate directly with infrastructures (V2I), pedestrians (V2P), and the greater network (V2N).

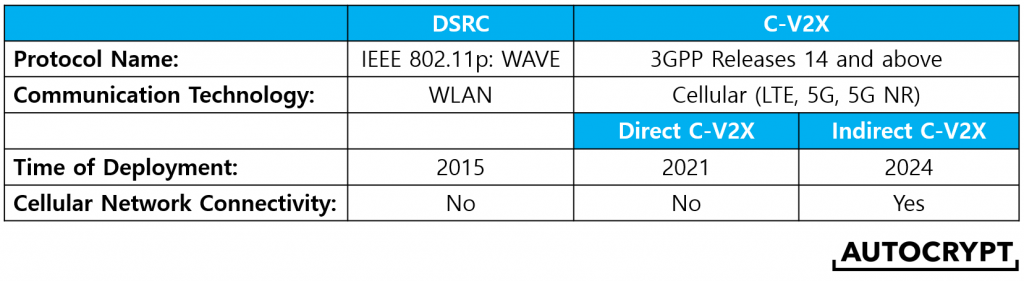

In a previous blog article, we have discussed in detail on what V2X technology is and how it is applied. To read that article, see: DSRC vs. C-V2X: A Detailed Comparison of the 2 Types of V2X Technologies. Today, we are here to look at seven of the major functionalities and benefits of C-ITS and how they paint the full picture of autonomous driving.

1. Collecting driving data

All kinds of driving data – including location, speed, time, and vehicle condition – are collected from the vehicles’ on-board units. These data (when given consent by the owners) will be stored a data center accessible by transportation regulators and infrastructure developers to help enhance transportation infrastructure and road safety. Sometimes, automakers (OEMs) also collect data of their cars to further improve their models with software updates and hardware improvements.

2. Exchanging real-time information on traffic

As vehicles share their location and speed with each other, a massive transportation network consisting of real-time data is formed. Every vehicle can then utilize the collective information on the current traffic flows and even analyze them to predict future traffic conditions in the next few hours. This allows all vehicles to choose an optimized route for their destination, significantly reducing traffic jams while saving time and money spent in traffic.

3. Exchanging real-time information on road hazards

Traffic data are not enough to guarantee road safety. With C-ITS, vehicles receive data on a wide range of information on road conditions, including road surface temperature, humidity, and buildup of snow and rain from precipitations. Vehicles are also warned of curvy and slopy roads, road breakage, as well as areas where traffic accidents frequently occur. Lastly, information on emergency road maintenance and road construction gets shared with vehicles to make sure that they are well-informed of road hazards and respond safely by reducing speed or detouring.

4. Exchanging real-time information on vehicle hazards

The smart traffic network also collects live information on dangerous vehicles such as trucks and buses, as well as those traveling at abnormally fast or slow speeds. Surrounding vehicles then get notified to stay aware of such hazards. In case accidents occur, vehicles behind will be directed to reduce their speed to prevent secondary accidents, because most traffic-related deaths involve secondary accidents. The locations of emergency vehicles are also shared so that other vehicles on the road can clear out a line ahead of time, allowing them to pass by quickly.

5. Directing traffic at intersections

Even though traffic lights are designed to protect the safety of cars and pedestrians at intersections, there are still conflicting situations where safety fully depends on the driver’s judgment. Take the left turn for example, drivers need to simultaneously pay attention to three different things: 1) the signal ahead, 2) cars traveling down from the opposite direction, and 3) pedestrians on the left-side crosswalk. One misjudgment can lead to danger. With C-ITS, this conflict resolution process gets sorted out automatically, significantly improving safety at intersections.

6. Toll collection

Roadside infrastructure tracks the identities of vehicles entering toll roads. The respective toll fees then get deducted automatically from the financial accounts pre-registered to each vehicle, making the payment process seamless. Since there is no longer the need to slow down at toll stations, highway traffic jams can be partially relieved.

7. Pedestrian protection

The ultimate goal of autonomous driving is to guarantee the safety of both drivers and pedestrians. With C-ITS, vehicles are directed to slow down in both school zones and silver zones. With V2P technology, cars receive data from the pedestrians’ mobile devices so that even when the pedestrian is hidden in sight, the car can still prepare to stop ahead of time. This is especially useful at intersections where pedestrian-related accidents are most common.

The Importance of Data Security for C-ITS

Cooperative intelligent transport systems are supported by all kinds of data from drivers, vehicles, and infrastructures. Even though these data might not necessarily contain personally identifiable information (PII), information on a city’s transportation infrastructure can still be exploited by malicious actors to commit various crimes. Furthermore, the messages in transmission also needs to be protected to prevent manipulations, which could lead to severe physical damages.

AutoCrypt V2X is a software-based security solution that is built into the chipsets embedded in both on-board units and roadside units, helping protect data privacy while ensuring the accuracy of the shared messages. As a major mobility security supplier for OEMs, chipmakers, and infrastructure developers, AUTOCRYPT has been collaborating with the government in a number of C-ITS projects.

To keep informed with the latest news on mobility tech, automotive cybersecurity and cooperative intelligent transport systems, subscribe to AUTOCRYPT’s monthly newsletter.