Discussions surrounding transportation technologies have always been dominated by the automotive industry, with electric vehicles and autonomous driving being the two hottest topics recently. But we seldomly hear about how these technologies can be applied for public transit and mobility services. There is no doubt that the automotive industry has been driving innovations and breakthroughs through electrification, automation, and connection. Yet, the automotive industry is only one part of the mobility scene. Other forms of public and private transit make up a significant part of our daily travels as well. Therefore, it is equally important to apply the technologies to these industries. To truly improve the quality of mobility for all, we need to think beyond the perspective of drivers and seek ways to make travel better and more enjoyable for all kinds of passengers.

The good news is that there are many firms in the industry actively working on applying these transformative automotive technologies to other areas of mobility. Among them, demand-responsive transport (DRT) is one of the fastest-growing fields, with the potential to revolutionize mobility for all.

What is Demand-Responsive Transport?

For generations, public transit has always been a supply-oriented service, in which the time and location of supply is fixed on a schedule; ultimately, the user needs to adapt to the schedule to use the service. Such services are quite inconvenient for people living in suburban and rural areas, and nearly impossible to use for those with accessibility needs.

Demand-responsive transport (DRT) has the potential to solve these problems as it responds to individual demands by either matching passengers with the nearest supply available, or dispatching supply directly to serve them. A centralized system collects real-time location and occupancy data from every vehicle in the network, then uses these data to calculate optimized matches.

DRT can take many forms and opens a wide range of business opportunities. For instance, it can either be directly operated by a fleet owner or be entirely decentralized where drivers and riders meet through a third-party platform. In fact, one of the most well-established DRT services is ridesharing platforms, where independent drivers use their own cars to offer services to passengers. The role of the platform is to match the demand of the passengers with the supply from the drivers. These ridesharing platforms have been well received among urban millennials and have become a popular alternative to driving. However, apart from ridesharing platforms, there are many other applications of DRT that are less known. In this article, we will introduce how DRT is applied in a variety of mobility services.

Demand-responsive public transit

Believe it or not, DRT has already been applied to many of our public transit systems. Many public transit operators use real-time fleet data to increase efficiency and reduce the cost of fixed-route services. This is widely used for bus routes as buses are highly susceptible to unexpected traffic situations. The fleet managers receive data with regards to time, location, and vehicle occupancy rates, and redirect buses based on the data. This is especially useful during times of single-bound heavy traffic, where there can be many buses stuck in traffic going in one direction while the other direction without traffic is left with no buses at all. Under such situations, the fleet manager could ask the passengers of a relatively empty bus to get off and wait for the next bus behind, while redirecting the bus for a U-turn to serve the opposite direction.

Of course, the U-turn method is far from perfect since it would cause inconvenience to a small group of passengers. But the advanced fleet management systems today allow for more automated monitoring by studying the data patterns to predict times of unbalanced traffic and dispatch buses accordingly ahead of time.

Personalized transit services for rural and underpopulated areas

It has always been difficult for local governments to provide public transit to rural areas with low population density. Residents living in these areas might only get a few buses a day arriving at their stop, making public transit unusable. In this case, many municipal governments collaborate with local startups to establish transit-booking platforms for rural residents. Instead of running on fixed routes, the customers can either call or use their mobile apps to book their trip ahead of time. The service will then be dispatched to accommodate the specific needs of each customer. Instead of operating a bus on a fixed route, these transit-booking services can significantly reduce unnecessary operating costs while making mobility easier for rural residents.

On-demand transit services for people with accessibility needs

In many parts of the world, publicly funded paratransit services can be very limited or entirely absent. Even in developed countries with well-established paratransit services, the response time can be slow and reservation ahead of time is usually required. With the help of vehicle connectivity and advanced fleet management systems, more responsive and convenient paratransit services are slowly being tested around the world.

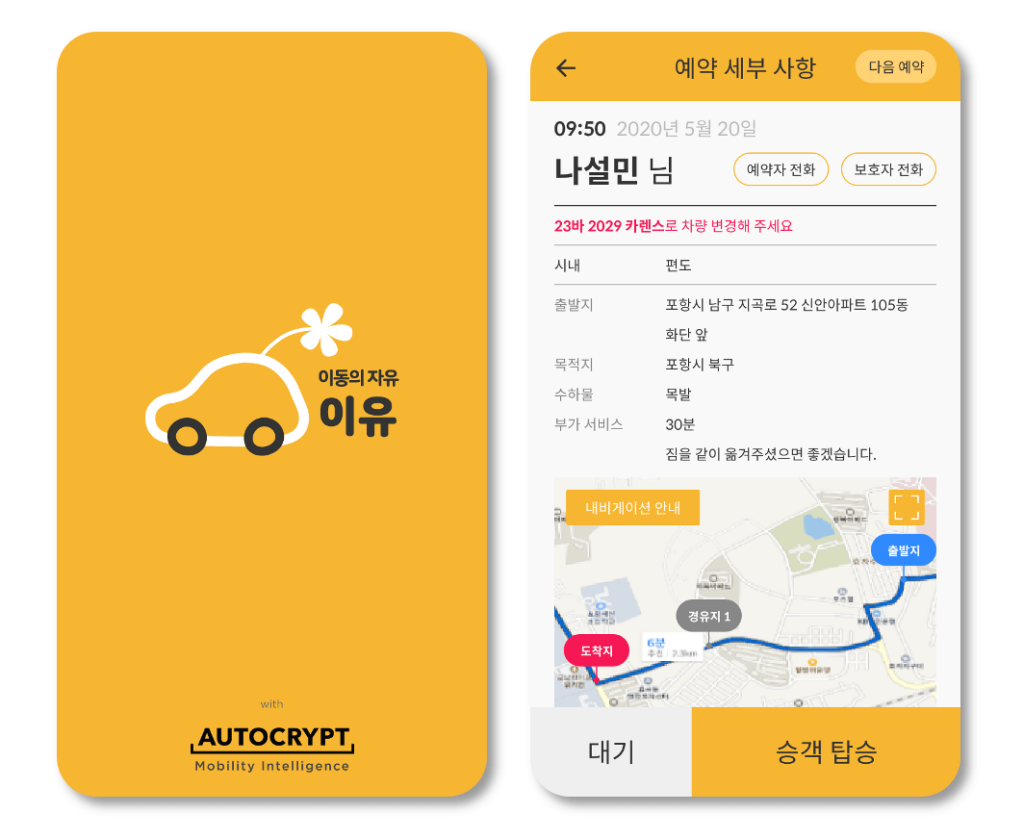

For instance, over the past year, AUTOCRYPT has worked with 2U Social Cooperative to establish a barrier-free transportation assistance platform for residents with accessibility needs in the city of Busan. Equipped with AUTOCRYPT’s fleet management system, the platform monitors the location of all vehicles in real-time, whereas the customers can request a vehicle anytime from the mobile app. Different from other mobility platforms, it also offers personalized accommodation such as text-to-speech services for those with vision impairments. Secure and automated payment is also supported.

The Technologies Behind Demand-Responsive Transport

The key to demand-responsive transport is internet connectivity and data sharing. To match demand and supply, fleet managers need to have access to the real-time location and onboard capacity of every vehicle, as well as the pickup location of every passenger. An advanced fleet management system makes this process even simpler as the system automatically analyzes the data to find the optimized match.

Clearly, demand-responsive transport systems need to share and process a lot of data, which may contain the personal and payment information of the passengers and drivers, as well as other information on driving behaviour and vehicle maintenance. Hence it is crucial to have the necessary security measures to keep communications safe from hackers and other external threats. As a result, encryption and authentication technologies are just as important as the internet connectivity itself.

AutoCrypt FMS builds fleet management solutions for demand-responsive transport by putting security as the number one priority, actively working with firms who wish to provide smart mobility services. By building a secure foundation for all vehicle-related connections, AUTOCRYPT seeks beyond the automotive industry and looks forward to bringing smart mobility for all.

To stay informed with the latest news on mobility tech and automotive cybersecurity, subscribe to AUTOCRYPT’s monthly newsletter.