Due to growing customer demand and tightening carbon emission quotas, nearly all automotive manufacturers today are undergoing a significant transition from producing ICE and hybrid vehicles to electric vehicle manufacturing, specifically battery-electric vehicles. Last month, Volkswagen Group announced its NEW AUTO strategy, a long-term plan that projected electric vehicles to make up 50% of the group’s total sales by 2030 and 100% by 2040. Earlier in the year, Hyundai Motor Group also unveiled its plan to increase its EV portfolio from the current eight models to 23 models by 2025. Other OEMs such as GM, Mercedes-Benz, BMW, and Volvo all have ambitious plans to increase their EV portfolio and grab as many early adopters as possible in this booming industry.

Will Traditional OEMs Dominate Electric Vehicle Manufacturing?

Many tend to take it for granted that traditional major OEMs will naturally take over all electric vehicle productions. This is a fair assumption because the automotive industry has always had extremely high entry barriers due to the economies of scale—an absolute advantage firmly held by large global OEMs. While producing one vehicle might cost millions, producing 100,000 vehicles reduces the per-unit expense down to the thousands.

However, the above assumption has a major flaw; that is, it underestimates how different EV production is compared to producing ICE vehicles. When making a new model of a hybrid vehicle, the manufacturer can still use the existing frame, design, and powertrain of its gasoline-powered siblings, with only some modifications needed to the original assembly plant. On the other hand, to build a battery-electric vehicle, OEMs need to start from scratch and consider a whole different set of problems when designing the frame and the powertrain, such as how to best fit the batteries at the base. As a result, OEMs cannot take advantage of their existing ICE-vehicle assembly lines to make EVs, and hence lose the economies-of-scale advantage.

In fact, despite a vibrant automotive industry, these traditional OEMs are facing their biggest threats in decades, if not ever. Tesla has proven that a startup with no experience in car manufacturing can rise to become a market leader in the EV industry. Over the past few years, countless startups and even tech giants like Apple and Sony are all trying to gain a foothold in the market.

Nevertheless, despite losing their absolute advantage, traditional OEMs still have a better chance of winning the EV race as they have pre-established brands that are well recognized and trusted by consumers. Therefore, OEMs should take advantage of their beloved brands to make a smooth and bold transition into the EV game.

Brownfield vs. Greenfield: Two Strategies for Electric Vehicle Manufacturing

To start manufacturing electric vehicles, the first big decision that traditional OEMs face is whether to adopt the brownfield or greenfield strategy. OEMs that choose the brownfield strategy need to do a significant overhaul to their existing ICE-vehicle assembly line to accommodate an EV assembly line. This strategy is commonly adopted by an OEM at its early stages of the EV transition, when it does not expect high sales in the short run. However, adopting the brownfield strategy also means that the OEM must abandon some of their existing ICE-vehicle lineups to create rooms for EV production. The more EVs produced, the more ICE-vehicle sales it needs to sacrifice.

Another alternative is to adopt the greenfield strategy. That is, to establish new facilities and plants dedicated specifically to electric vehicle manufacturing. Doing so requires significant investment, and whoever has the most cash has the greatest advantage to begin with. By adopting this strategy, OEMs put themselves side by side with new market entrants like startups and tech firms.

What Advantages Do Traditional OEMs Have?

During this transition period, it is almost certain that some of the traditional OEMs will lose the race to new market entrants. However, traditional OEMs do still have certain advantages over startups and tech firms. First, their experience and knowledge in the E/E (electrical and electronic) architecture mean that it takes less time for them to design and develop new vehicle models. Moreover, the pre-established quality assurance system also ensures that their vehicles will be more reliable overall than those built by new market entrants. Additionally, the suppliers are evolving with the OEMs. Large tier 1 suppliers like Bosch and Magna are now providing EV parts and solutions, meaning OEMs with existing supply chains can save time and cost in looking for new suppliers.

However, traditional OEMs must be aware that these advantages are not as significant as the absolute advantage they used to have. Therefore, to establish a firm foothold in the new EV market, OEMs must utilize these advantages in an efficient way as early as possible.

New Considerations in Electric Vehicle Manufacturing

Amid the fierce competition, OEMs must also consider a wide range of new challenges in the EV manufacturing process. Most of these are related to charging and range. How far can the car travel on a full charge? How long does it take for a full charge? How many charging stations are available in a certain area? Can the power grid accommodate all charging needs during peak times?

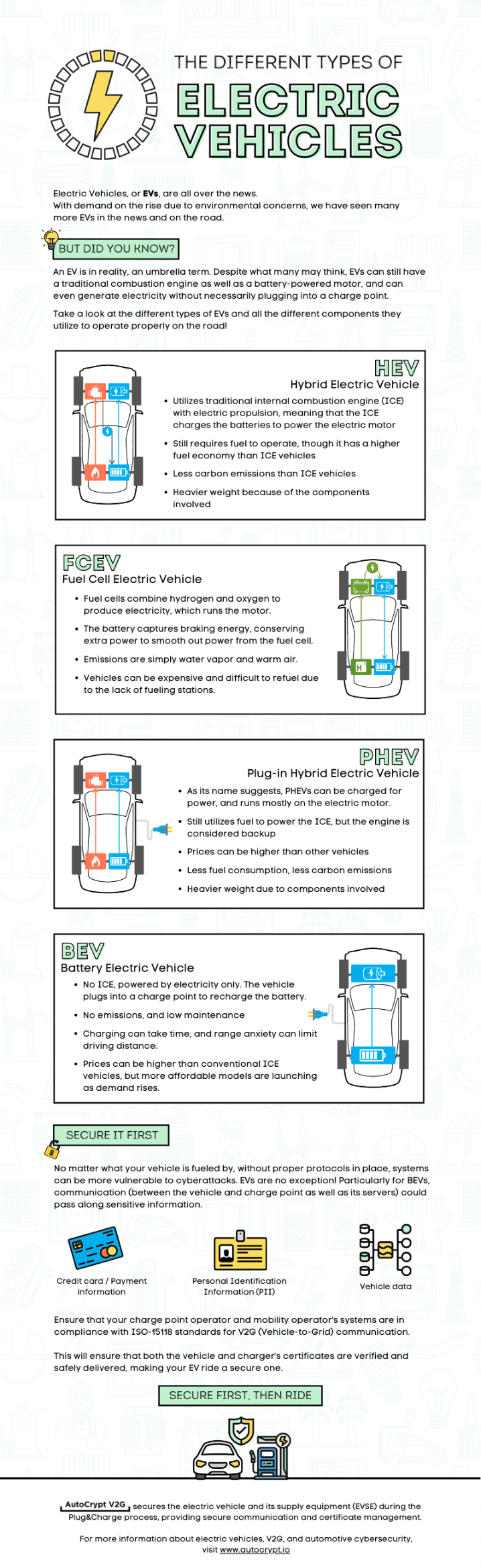

To solve these problems, OEMs, charger manufacturers, charging point operators (CPO), and mobility operators are working towards a new solution that makes EV charging smart and seamless. Utilizing the vehicle-to-grid (V2G) communication interface, Plug&Charge (PnC) is an EV charging technology outlined by ISO 15118 to allow bidirectional charging with a seamless user identification and payment process. Plug&Charge infrastructure allows the driver to plug in their car at any charging station without the need to carry membership cards and credit cards.

To integrate Plug&Charge technology, OEMs must ensure that their vehicles have the security measures to allow the safe transmission of vehicle and payment data. This is AUTOCRYPT’s role as a cybersecurity supplier. AutoCrypt PnC secures the Plug&Charge process using a PKI-based security system made by cutting-edge encryption and authentication technology.

As the above example shows, electric vehicle manufacturing requires the collaborative work of a wide range of different parties extending into infrastructure providers and cybersecurity firms. OEMs that are willing to adapt to these changes have a greater chance of succeeding in this new market. To stay informed with the latest news on mobility tech and automotive cybersecurity, subscribe to AUTOCRYPT’s monthly newsletter.