As climate change accelerates across the globe, facilitating a fast and smooth transition into electric vehicles (EV) and electric mobility (e-mobility) is now at the top of the agenda for governments, transport ministries, and the automotive and mobility industries. With tremendous investment and efforts pouring into the transition over the past several years, we have seen significant improvements in the quality, usability, and performance of EVs and their supply equipment (EVSE).

AUTOCRYPT considers contributing to the transition to e-mobility of utmost importance. That’s why we exhibited at this year’s EVS35 (Electric Vehicle Symposium and Exhibition) in Oslo, Norway to showcase our latest e-mobility solution EVIQ and propose our proprietary security framework for Plug&Charge (PnC). Being at the event also helped us gain insights into the latest trends in the fast-evolving e-mobility industry.

2022: The Tipping Point of EV Adoption

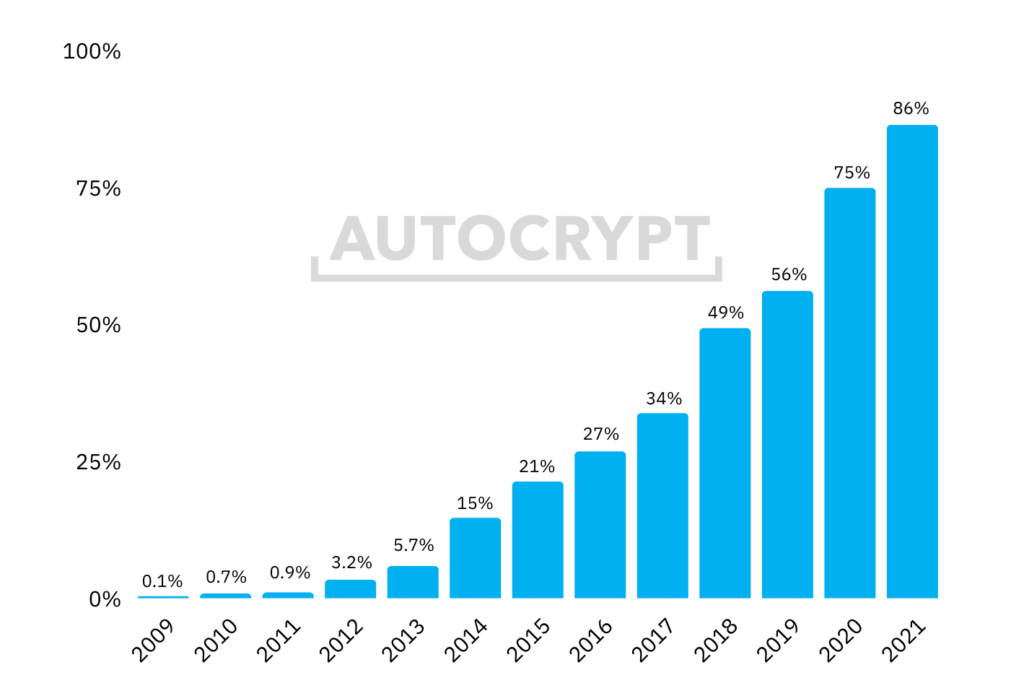

Although it can take quite some time before all vehicles on the road become electric, EVs are dominating new car sales in many countries. Norway, the leading country in EV adoption, showed a record-high annual EV market share of 86% over the year 2021, followed by another monthly record of 92% in March 2022. At this point, about 23% of all vehicles in use in Norway are EVs. Other leading EV adopters include Sweden, with an annual market share of 45% in 2021, followed by the Netherlands at 30%, Germany at 26%, Britain at 19%, France at 18%, and China at 15%.

Although Norway is currently the only country with an EV market share above 50%, there is little doubt that other countries will quickly catch up. Looking at Norway’s EV adoption pattern, it took about an equal amount of time for the market share to grow from zero to 20% and from 20% to 90%. This 20% mark can be seen as a tipping point, where adoption begins to accelerate.

This pattern can be explained by two reasons. The first is peer influence. Whenever a new technology is introduced to replace an existing one, a great majority of people try to wait until the early adopters have fully tested the technology before making a purchase. This effect is especially salient when making a high-involvement purchase like a car. Once one in five people (20%) start to purchase the new technology, the worries dissipate, and the general population begins their adoption. When reaching a stage where two in five people (40%) go for the new technology, people begin to feel peer pressure and refrain from purchasing the older technology due to fear of being left behind and loss of resale value.

The second reason is of course the growth in EV technology itself.

Based on this pattern, we can estimate that the EV market share in the EU (currently at 20%) will likely reach 80% in five years, and China (currently at 15%) will reach 80% in six years. These estimates do not take into consideration the accelerating growth of e-mobility technology and infrastructure so; by taking that into account, the EV market share in both EU and China could potentially reach 80% in as soon as four years.

Even in slower markets like North America, 2022 is on track to becoming a promising year. Canada’s EV market share grew from 3.8% in 2020 to 5.6% in 2021, showing great potential of reaching the 10% mark within 2022.

Widespread Commercialization of Plug&Charge and V2G Technology

The V2G (vehicle-to-grid) communication interface defined by ISO 15118 is a protocol designed for bidirectional charging/discharging between EVs and chargers. Within the standard is a feature called Plug&Charge (PnC), which enables an EV to automatically prove its identity to the charger on behalf of the driver, then exchange its digital certificate with the certificate of the charger to allow for automated payment. To enable PnC, both the vehicle and the charging station must be PnC-compatible.

The initial years after PnC’s release showed slow progress. After the Plug&Charge section was first added to ISO 15118 in 2014, not a single OEM had a functional implementation until 2018. A few OEMs began demo testing between 2019 and 2020. Eventually, some exciting results were shown in 2021. Several vehicle models – including Hyundai IONIQ 5, 2021 Porsche Taycan, 2021 Lucid Air, and 2021 Ford Mustang Mach-E – are now fully compatible with PnC. The same goes for charging stations. In 2021, both Electrify America and Electrify Canada deployed PnC to their charging networks in North America. Ionity also announced in late 2021 that all their charging stations across Europe are PnC-compatible.

Although it still seems like very few OEMs and charge point operators (CPOs) are implementing the technology, it is great news that PnC is now widely available for commercial use with mass adoption underway, and AUTOCRYPT is fully prepared to implement its AutoCrypt PnC secure charging framework to protect the personal and financial data of the driver during the PnC process, as cybersecurity has become a requirement in ISO 15118-20.

As for the bidirectional charging and energy distribution aspects of V2G, there are very few market implementations today, but the industry is making great progress. Many providers are beta testing V2G chargers capable of selling electricity back to the grid, with hope to bring bidirectional home chargers to the market in the next two years.

Elevated Environmental and Regulatory Pressure

Over the past decade, governments around the world have been using the incentive approach to encourage EV ownership. By subsidizing the costs of vehicle acquisition and e-mobility infrastructure development, EVs have now become affordable for most middle-income families. The availability of charging stations has also greatly improved.

With more climate disasters occurring across the globe, governments are now pushing forward a disincentive approach by putting regulations in place to “punish” carbon emitters. In 2020, the European Union’s Regulation (EU) 2019/631 entered into force, setting specific emission targets for OEMs. For every year between 2020 and 2024, the average CO2 emission for an OEM’s entire fleet registered in the year must be kept below 95 g/km for cars and 147 g/km for vans. If the average emission figure exceeds the target, the OEM must pay an excess emissions premium (EEP) at 95 euros per every g/km exceeded, multiplied by the total number of its newly registered vehicles in the EU in that year. To further incentivize EV production, the regulation also adds a super-credits system for low-emission vehicles with less than 50 g/km, by loosening the targets for OEMs that sell more of these vehicles.

As a simplified example, a 2.5 L gasoline-engine 2022 Hyundai Sonata has an emission rate of 182 g/km, which exceeds the 95 g/km target. If Hyundai wants to avoid paying the EEP, it must sell a lot of IONIQ 5s in that same year to both loosen the target figure (to above 95 g/km) and pull its total average figure down.

Starting in 2025, the target emission standards will become stricter and set out on a per OEM basis as a percentage reduction from their 2020 starting points, encouraging continuous progress.

Adoption of eMobility in Fleets

Electric vehicles are not only becoming popular among consumers, but many companies have started adopting EVs for commercial use. Mobility service operators were among the first to adopt all-electric fleets, because EVs today are easily capable of ranges above 350 km, well above the daily needs of most MaaS and taxi drivers. Additionally, since gasoline prices around the world nearly doubled over the past two years, the electrification of commercial vehicles has become a necessary cost-saving measure for many businesses.

A more exciting trend is the electrification of heavy-duty commercial vehicles like delivery vans, semi-trailer trucks, and buses. Only a couple of years ago, all-electric heavy-duty vehicles were considered barely viable due to technological limitations in batteries and motors. Thanks to accelerating technological growth and decreasing battery prices, heavy-duty EVs have become widely available, with over 100 models of heavy-duty electric trucks and buses in the market today.

Of course, infrastructure must also be upgraded to match the needs of heavy-duty EVs. Charge point operators are expanding their networks of high-speed DC chargers with charging speeds above 250 kW, which can charge a semi-truck in about two hours. Since time is crucial for logistics companies, charger manufacturers have also been working on Mega chargers specifically designed for trucks, namely the Megawatts Charging System (MCS). These charging systems are capable of charging speeds in the megawatts range, capable of filling a semi-truck in minutes.

Lastly, investing in an all-electric fleet also gives the fleet operator the potential of participating in V2G bidirectional charging when it becomes more available in the coming years, allowing the operator to make profits from their unused fleets.

AUTOCRYPT’s Work Towards Connected eMobility

As an automotive cybersecurity and mobility solutions provider, AUTOCRYPT plays a range of roles in bringing convenience and security to e-mobility. Starting from AutoCrypt PnC, a PKI-based security module that secures the PnC charging framework, AUTOCRYPT expanded its offerings by launching its e-mobility solution, EVIQ, an all-in-one EV information and charging platform that provides a Charging Station Management System for CPOs as well as charger locator maps for EV drivers.

To learn more about AUTOCRYPT’s e-mobility offerings, contact global@autocrypt.io.

To stay informed and updated on the latest news about AUTOCRYPT and mobility tech, subscribe to AUTOCRYPT’s quarterly newsletter.