What Is Universal Mobility?

Universal mobility refers to the state in which everyone has access to reliable means of transportation for necessities like going to work and school, accessing public services and healthcare, as well as shopping and socializing. Despite being taken for granted by many, there is a significant percentage of the population whose basic mobility needs are not met.

Achieving universal mobility can indeed be challenging, considering that car ownership might not be a viable option for everyone, and that there are many less-developed nations as well as sparsely populated regions where transit services are not financially sustainable. What’s more, even in places with adequate transit services, they can be difficult or impossible to access for those facing mobility challenges—for instance, people with temporary or permanent disabilities, parents of young children, and older people who need moving assistance. According to WHO estimates, 1% of the world’s population needs a wheelchair, while 3.2% of the world’s population is affected by blindness or some form of visual impairment.

Universal mobility is only said to be achieved when every member of the society—regardless of their place of residence, financial status, and physical condition—can enjoy reliable transportation on a day-to-day basis.

The Two Barriers to Universal Mobility

There are two main barriers to achieving universal mobility. The first is systematic barrier. This can be defined as a lack of motivation and initiative to improve transportation infrastructure for those in need. This could be due to a lack of public awareness with regard to accessibility needs or incompetent governments.

A second barrier is financial barrier. Even with strong motivation and improvement plans, financial challenges tend to prevent these plans from turning into actions. Problems such as high operational and maintenance costs and expensive fares make it difficult to expand transit services for sparsely populated regions and improve accessibility.

In many parts of the world, financial barrier has been the biggest obstruction to the path towards universal mobility. Indeed, building and maintaining transit services is expensive. Operating accessible transit services is more expensive. Even some of the largest metropolitan transit operators with millions of daily passengers can experience frequent budget deficits that need to be filled by government subsidies. For decades, governments around the world have been trying to solve these issues with policy changes but saw no significant improvements.

To break through the financial barrier, maintaining profitable services is crucial. Even though profitability and universal mobility may sound contradictory, they are in fact mutually inclusive. It is important to acknowledge that universal mobility is only achievable if all services are capable of long-term financial sustainability. In this regard, several newly developed mobility technologies offer great potential.

A Technological Path Towards Universal Mobility

Rather than struggling with endless policy changes, we can pave a technological path to improve transportation coverage and achieve universal mobility. With the integration of smart mobility technologies, we can make transportation and mobility services more sustainable by cutting down unnecessary costs and improving efficiency.

V2X and Autonomous Driving

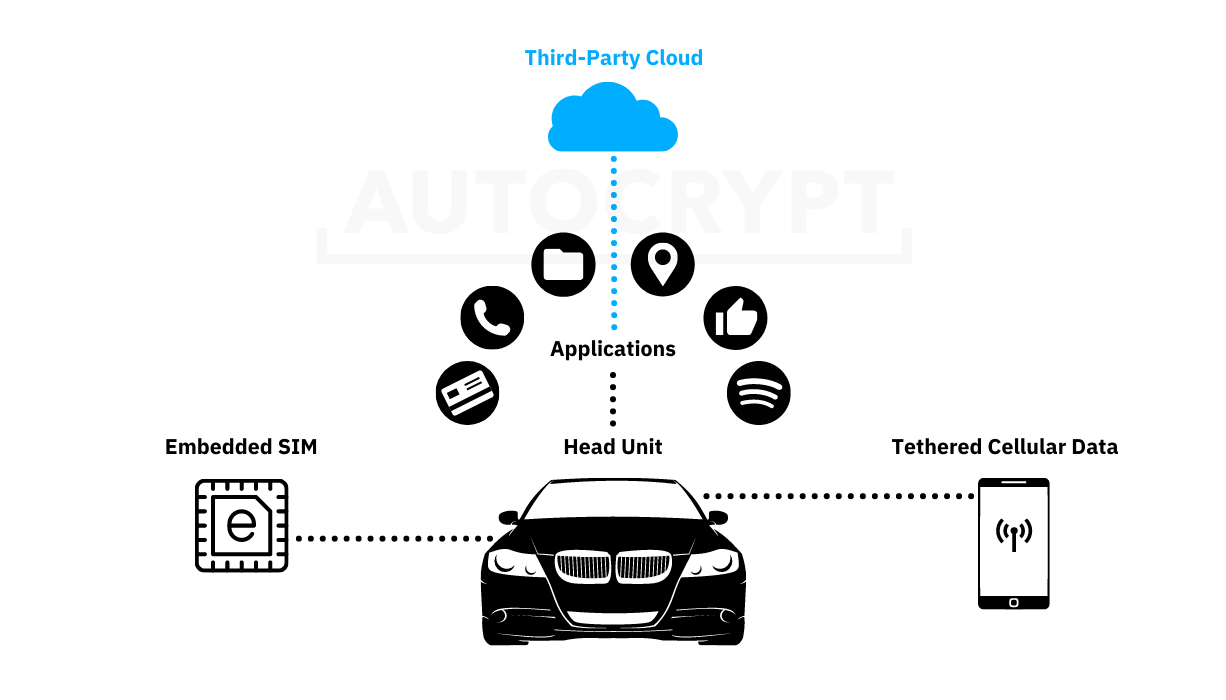

V2X (vehicle-to-everything) is the wireless communication technology used for real-time message transmission from vehicles to vehicles (V2V), vehicles to infrastructure (V2I), and vehicles to pedestrians (V2P), making it an essential building block for L3+ autonomous driving. How does autonomous driving help achieve universal mobility?

Even though taxi and mobility services are common in cities, they are less common and often nonexistent in smaller towns and rural regions due to a lack of profitable business models. With L4 and L5 autonomous driving, mobility service operators can deploy autonomous vehicle fleets in these less-populated regions to fill the unaddressed demands, without incurring the cost of hiring new drivers.

Fleet Management and Service Optimization

From the perspective of a mobility service operator, every mile on the road without a passenger indicates an opportunity cost. Hence, minimizing vehicle vacancy is crucial to the long-term financial sustainability of a mobility service. A fleet management system collects mechanical and location data from every vehicle in real-time, allowing the service platform to match demands to their closest supplies and map out optimized routes to the destinations, ensuring that the vehicle fleet is utilized to its maximum capacity.

In fact, in terms of serving sparsely populated regions and those with special accessibility needs, demand-responsive transport (DRT) services are much more efficient than fixed-route transit. With the help of big data and AI, barrier-free DRT services have great potential in such niche markets.

For this reason, AUTOCRYPT started its barrier-free DRT solution, AutoCrypt EQ, helping businesses establish accessible DRT platforms for those with mobility challenges, while ensuring that all data shared through the platform are end-to-end encrypted and verified.

Reliable Transport Enhanced by Connectivity

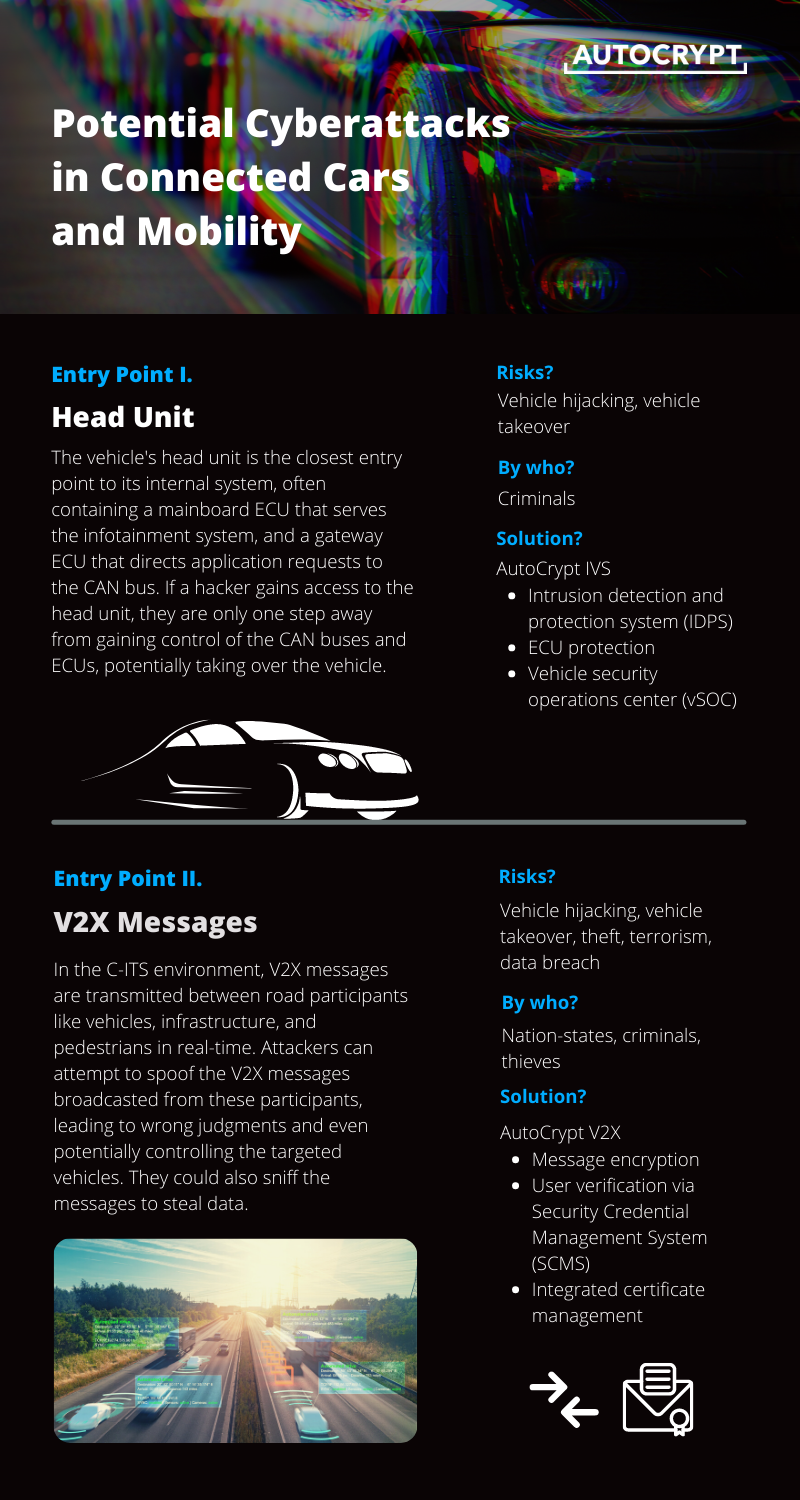

Although cutting down unnecessary expenses is beneficial, maintaining reliable and high-quality service is equally important for achieving universal mobility. Ensuring that all services are safe, secure, and reliable is a crucial task not only for mobility service operators but also for automotive OEMs. With the accelerated adoption of vehicle connectivity and autonomous driving, it is more important than ever to secure vehicles from hacking attempts and unauthorized access. As mandated by industry regulations and standards, many automotive OEMs now run a Vehicle Security Operations Center (vSOC) that monitors the real-time security status of their active vehicles using data collected from the OEM cloud, while identifying and reporting any potential intrusions immediately.

New Business Models for Universal Mobility

These new smart mobility technologies are not only beneficial to existing service providers. They also encourage new operational models and provide growth opportunities for businesses and NGOs that look forward to improving transportation coverage and accessibility. These new business models not only have the potential to break through the typical financial challenges of public transit, but also generate more initiatives in serving niche markets and bring us closer to universal mobility.

AUTOCRYPT shares this vision and is actively working with partners to develop innovative mobility service models in the form of DRT services, accessibility mapping, and multi-modal MaaS platforms.

To learn more about AUTOCRYPT’s mobility service solutions, contact global@autocrypt.io.

To stay informed with the latest news on mobility tech and automotive cybersecurity, subscribe to AUTOCRYPT’s monthly newsletter.