2022 was a turbulent year for the mobility industry. As the economy has been recovering back to its pre-pandemic state, we have seen a surge of technological advancements that are shaping the industry.

To commemorate the end of the year we have carefully analyzed the market and gathered four key insights to discuss the biggest trends of 2022 and see what the trajectory for the future of the mobility industry looks like.

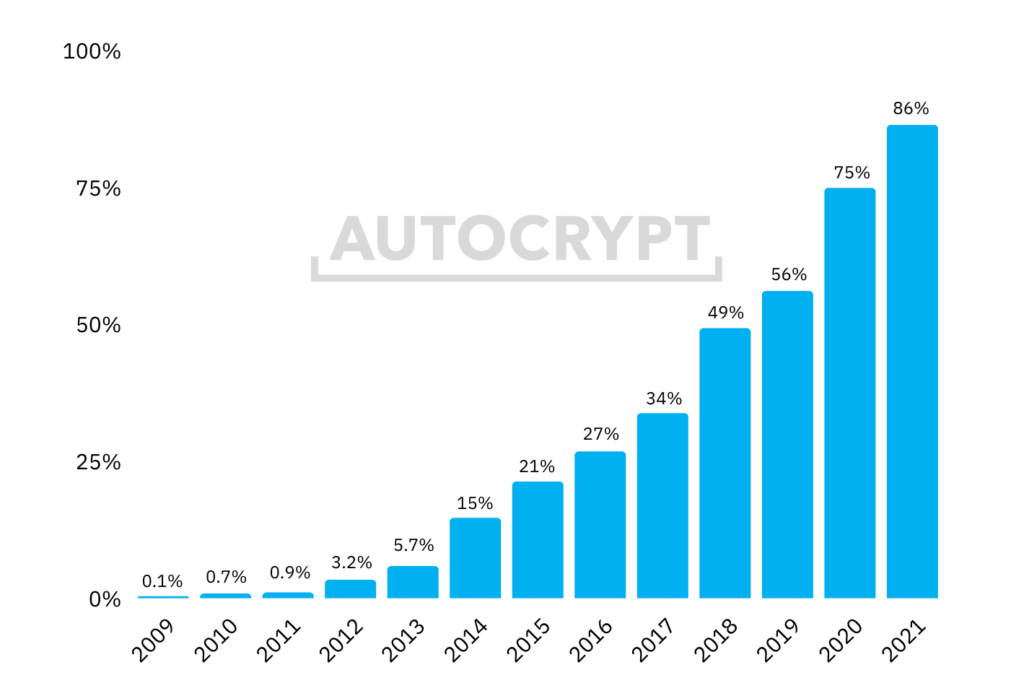

1. The tipping point in EV adoption

In 2022 we have seen the catastrophic impact of the climate crisis on our planet. The world was struck by extreme heatwaves in Europe, hurricanes across multiple US states, and monsoon floodings in Asia. The intensity of these devastating climate disasters has been increasing as a result of climate change. And as the global climate crisis continues to unfold governments are taking action to tackle the dangers of climate change by rolling out net-zero carbon emission policies to accelerate the road to decarbonization.

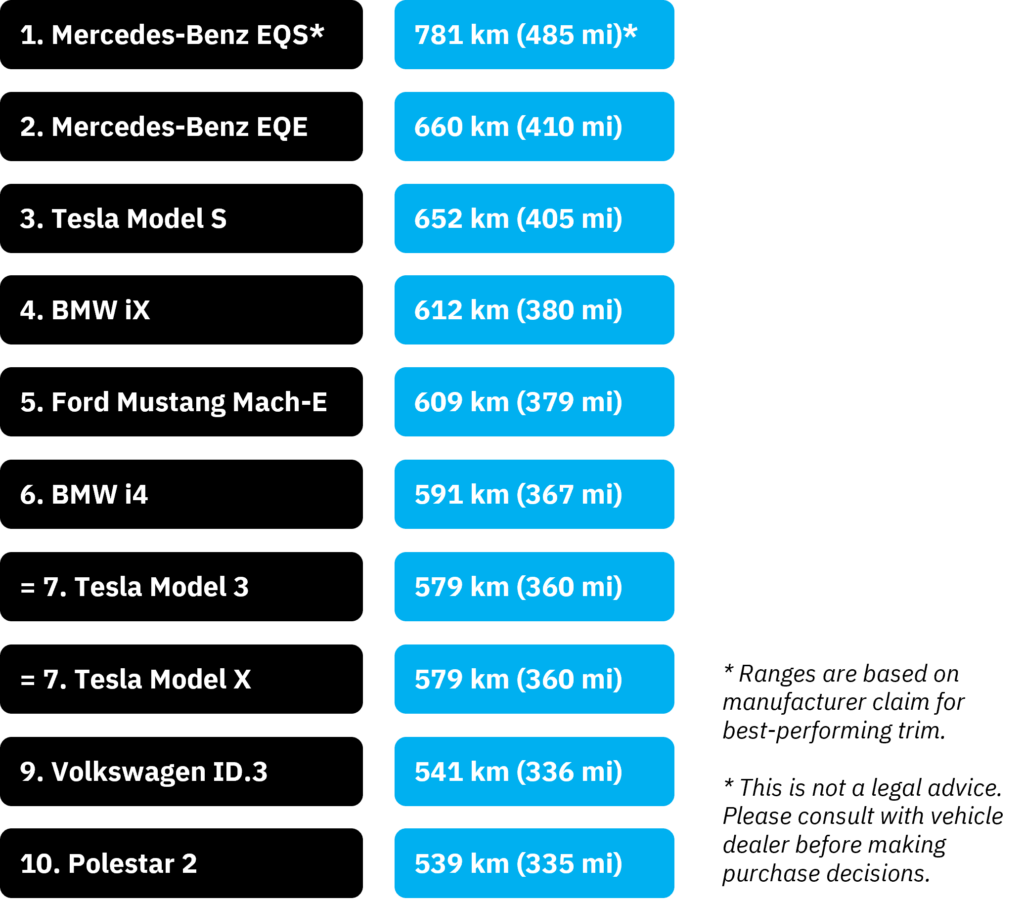

One of the largest industries contributing to the climate crisis is transportation, which is responsible for 20% of carbon emissions worldwide. Decarbonizing the mobility and transportation sector is imperative in reaching net-zero goals, and electrifying the roads is the most effective way to do so. Electric vehicles have been at the forefront of the transition in the mobility industry. As the world strives toward net-zero emissions, governments are increasingly pushing for electric vehicle (EV) adoption through subsidies and related policies. Europe and the United States are leading way with regulatory targets of reaching a 50% EV market share by 2030. On the other side of the spectrum, consumers are becoming more environmentally conscious and increasingly willing to make the switch in favor of electric vehicles. And as the technology gets more advanced the supply side is catching up with the demand.

The EV adoption rates are signaling a positive change in the market and bringing us closer to reaching net-zero goals in the transportation sector. However, we are still far from achieving decarbonization and need to take drastic measures in accelerating EV adoption across the board. Continuing to expand the charging infrastructure, supporting change with government policies and subsidies, as well as encouraging innovation are some of the key steps we need to take to meet decarbonization targets.

2. Autonomous driving

Electrification on the roads lays down the groundwork for further innovation opportunities in the mobility industry. To accommodate EV production, manufacturing facilities had to be redesigned and rebuilt from scratch, this allowed OEMs to trial new technologies and software in their vehicles. As the EV market grows, we can see the expansion in related automotive technologies, with innovations ranging from connectivity to autonomous driving.

The buzz around autonomous driving technologies has been around for a while; rightfully so, as autonomous driving technologies are extremely beneficial in increasing road safety and access to mobility. And 2022 was a notable year for the collective movement toward achieving higher levels of autonomy. Currently, major OEMs have achieved Level 3 autonomy, or conditional autonomy, where the vehicle can drive itself under appropriate conditions, but a human driver must always be present in the car. The main technology that allowed us to achieve Level 3 autonomy is Advanced Driver Assistance Systems or ADAS. ADAS uses radars, cameras, ultrasound, and a variety of different software to achieve vehicle automation. While ADAS is an essential element in providing autonomous driving, it is simply not enough to achieve higher levels of autonomy.

Autonomy Levels 4 and 5 entail high levels of autonomy with minimal to no intervention from the driver. To achieve these advanced autonomy levels, we need more comprehensive technologies such as connectivity. At the heart of vehicular communication technologies, we have vehicle-to-everything (V2X) technology that connects the vehicle to the network, infrastructure, other vehicles, and passengers around it. V2X communication utilizes wireless communication between the vehicle and the environment around it to gather real-time data on traffic conditions, road signs, warnings, and much more. V2X technologies are also very beneficial in ensuring road safety as they include connectivity with other vehicles (V2V) and pedestrians on the road (V2P).

This technology can greatly improve the effectiveness and accuracy of existing ADAS technologies and fast-track the path to full automation.

3. Universal mobility

EV passenger vehicle numbers are growing, but so do the numbers of EV commercial fleets. In the past years, we have seen governments deploy electric buses, trams, and taxis in attempts to decarbonize public transport systems as well as increase access to mobility. Universal mobility entails having access to transportation for all members of society. The ultimate goal is to achieve universal basic mobility (UBM) and democratize the sector so everyone can access safe and efficient transportation. Among the latest technologies aimed to provide UBM are mobility-as-a-service (MaaS), robotaxis, and carsharing services.

The emergence of MaaS is not surprising, as it allows access to transportation for everyone who owns a smartphone. MaaS is currently on the rise with multiple successful cases worldwide, namely Kakao Mobility, Uber, and Lyft. These companies have been able to integrate multiple modes of transportation into a user-friendly mobile application, making transportation easily available to people at the tap of their fingers.

As MaaS continues to grow businesses will need assistance in rolling out their own mobility services. AUTOCRYPT launched its mobility service solution AutoCrypt® MOVE, integrating its fleet management system with big data analysis and demand-oriented service modeling to help businesses and NGOs easily establish their own mobility services and reach universal basic mobility.

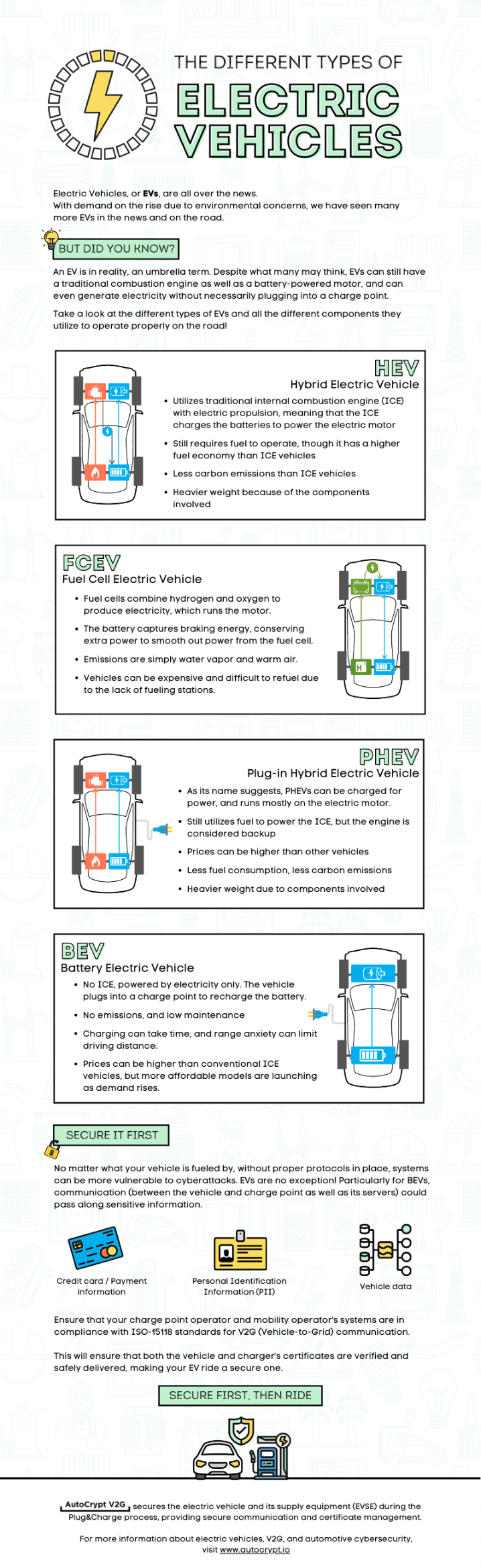

4. Increasing need for cybersecurity

As vehicles become increasingly automated and connected, the need for effective cybersecurity measures becomes more important. With the proliferation of connected vehicles, hackers have more opportunities to gain access to vehicle systems and potentially cause harm. In addition, the increased use of automation in vehicles means that there are more potential points of failure that could be exploited by malicious actors.

One of the main reasons for the increasing need for cybersecurity in the automotive industry is the growing number of connected vehicles on the road. Many modern vehicles are equipped with internet connectivity, which allows them to communicate with other vehicles and with external systems, such as traffic control systems and other infrastructure. This connectivity opens new possibilities for vehicle operation and convenience, but it also creates new vulnerabilities that can be exploited by hackers. For example, a hacker who gains access to a connected vehicle could potentially take control of the vehicle’s systems, including its brakes, steering, and acceleration. This could result in dangerous situations, such as collisions or loss of control. In addition, a hacker could potentially access sensitive personal information stored in the vehicle, such as location data or information about the vehicle’s owner. Exactly that happened in January of this year when a researcher was able to hack into 25 Tesla vehicles and gain access to vehicle control and the personal information of car owners.

Another reason for the increased need for cybersecurity in the automotive industry is the growing use of automation in vehicles. Many modern vehicles are equipped with ADAS and vehicular communication technologies, which can assist with tasks such as lane keeping, automatic braking, and adaptive cruise control. While these systems can improve safety and convenience, they also introduce new potential points of failure that could be exploited by hackers.

Overall, the increasing use of automation and connectivity in vehicles is creating new challenges for cybersecurity. To protect against these challenges, it is important for the automotive industry to develop and implement effective cybersecurity measures. This may include measures such as encryption, secure authentication, and regular over-the-air (OTA) software updates to protect against known vulnerabilities.

This year has seen positive strides in the mobility industry. The expansion of electric vehicle adoption, autonomous driving, universal mobility, and cybersecurity points to an industry-wide trend toward electrification, decarbonization, and innovation. However, in order to achieve the full potential of the technological shift within the sector we must remember to support this expansion with government policies, investments, and innovation.

As an automotive cybersecurity and mobility solutions provider, AUTOCRYPT offers secure connectivity technologies that support the expansion of the mobility sector. From securing V2X communications to embedded vehicular systems, AUTOCYRPT ensures that all connections are secured before vehicles hit the road.